2024 Financial Statements Bulletin: key takeaways in a Q&A format

Canatu published its Financial Statements Bulletin on 28 March 2025. Below, we summarize the key takeaways in a Q&A format, responding to the most frequently asked questions related to the report.

You can find the Finnish version here.

Canatu’s pro forma revenue grew by over 60% in the financial year 2024 and was approximately EUR 22 million. What were the key growth drivers?

- The growth was based on strong development in the semiconductor business.

- Semiconductor business’ pro forma revenue increased by 77.2% to EUR 19.7

million (11.1). The increase in semiconductor revenue was mainly driven by CNT100 SEMI reactor delivery projects to global semiconductor customers. - Automotive business’ pro forma revenue decreased by 7.3% to EUR 2.3 million (2.4). The decrease was due to lower revenue from one of the main customer, which reduced its inventory levels.

- Medical diagnostics business’ pro forma revenue amounted to EUR 0.0 million (–).

Your pro forma gross margin increased by over 40% and was EUR 13.8 million. However, your pro forma gross margin as a percentage of revenue decreased and was 62.5%. What was the reason for that?

- Revenue growth supported the absolute gross profit growth.

- The decrease in pro forma gross profit as a percentage of revenue was due to a changed product mix as a result of the shipping the first two CNT100 SEMI reactors to customers and their revenue recognition for the financial period.

Your adjusted pro forma EBIT as percentage of revenue decreased and was -21.9%. What was the reason for that?

- Pro forma EBIT as percentage of revenue decreased mainly due to weaker gross margin and decrease in government grants in relation to the comparative period.

- However, our personnel expenses and other operating expenses grew more slowly than revenue during the financial year, which had a positive impact on the relative profitability.

Your pro forma investments in the financial year 2024 were approximately EUR 5.0 million. What were those investments targeted at?

- Our key investments focused on a new automated production line, an ISO3 cleanroom, advanced instrumentation, coating technology, and patents.

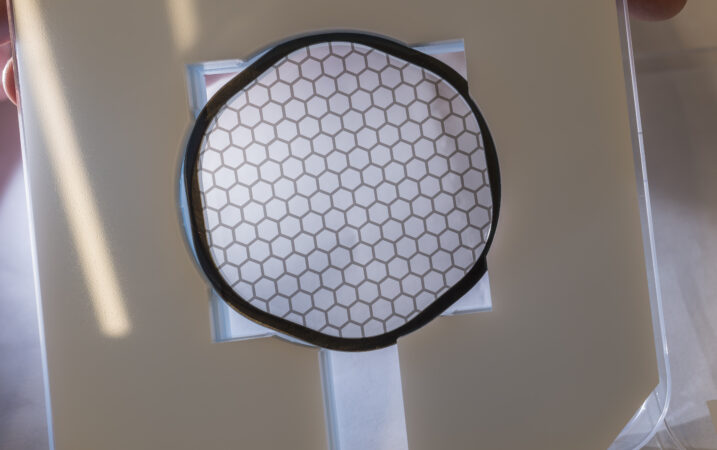

You shipped the first two CNT100 SEMI reactors to your customers during the financial year. How are those reactor deliveries progressing? Have you received recurring royalty and consumable income from the reactors?

- Reactors and related peripherals are currently being installed at customer sites. After that the customers will complete the final Site Acceptance Tests (SAT). We expect these SATs to be completed in 2025.

- We expect that recurring royalty and consumable revenue will only begin once customers have completed SATs and start ramping-up the high-volume production of ready CNT pellicles. The start of high-volume production is also subject to customers obtaining the necessary approvals for their ready CNT pellicles.

Do you have ongoing negotiations regarding new reactor deliveries to existing or new customers?

- Yes, we do have ongoing negotiations regarding new reactor deliveries with both existing and potential new customers.

- We expect that potential follow-up orders for CNT100 SEMI reactors from the existing customers will likely also depend on the success of the final Site Acceptance Tests (SAT) of the first two CNT100 SEMI reactors and related peripherals that were shipped in 2024.

Canatu received gross proceeds of over EUR 100 million in connection with its listing in the fall of 2024. How do you plan to use those proceeds?

- We are moving full speed ahead, accelerating investments in both our existing businesses and future developments.

- We continue to strengthen our team with key hires and enhance our systematic screening of opportunities in collaboration with partners to discover emerging new applications for our advanced CNT.

- We expect our key investment areas in financial year 2025 to be:

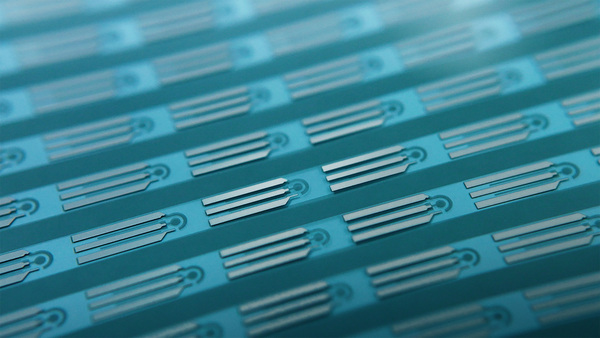

- Developing updated and new semiconductor reactor generations to meet future CNT pellicle membrane requirements

- Developing optical filter products for the semiconductor EUV inspection membrane market

- Accelerating medical diagnostics development

- Finalizing a second fully automated production line for automotive and medical diagnostic products, increasing productivity by 50%

- Advancing future solar cell technology with a partner to achieve potentially higher efficiency

- Establishing CTO team to address emerging future applications for our advanced CNT

How do you expect Canatu’s business to develop in the financial year 2025 and beyond?

- We see that Canatu’s long-term potential in the three business focus areas—Semiconductor, Automotive, and Medical Diagnostics—has remained unchanged.

- We expect that our revenue for the financial year 2025 will be weighted towards the second half of the year. This is primarily driven by the anticipated timing of potential new CNT100 SEMI reactor orders and the associated revenue recognition of such orders.

- In the near term, we see that there are certain factors, which affect the revenue visibility and may increase the volatility of the company’s revenue development, particularly in the Semiconductor and Automotive businesses. For example, the roll-out of ready CNT pellicles ultimately depends on our customers and their processes.

- In accordance with our disclosure policy, we don’t issue any specific numerical guidance or other financial outlook for the financial year 2025 at this point. However, we will assess the possibility of issuing such guidance or outlook later during the financial year.

Read the whole Financial Statements Bulletin here.

Canatu will publish its Annual Report for the year 2024, including the Financial Statements and the Report of the Board of Directors, on week 16.

Contact